features

Taking stock

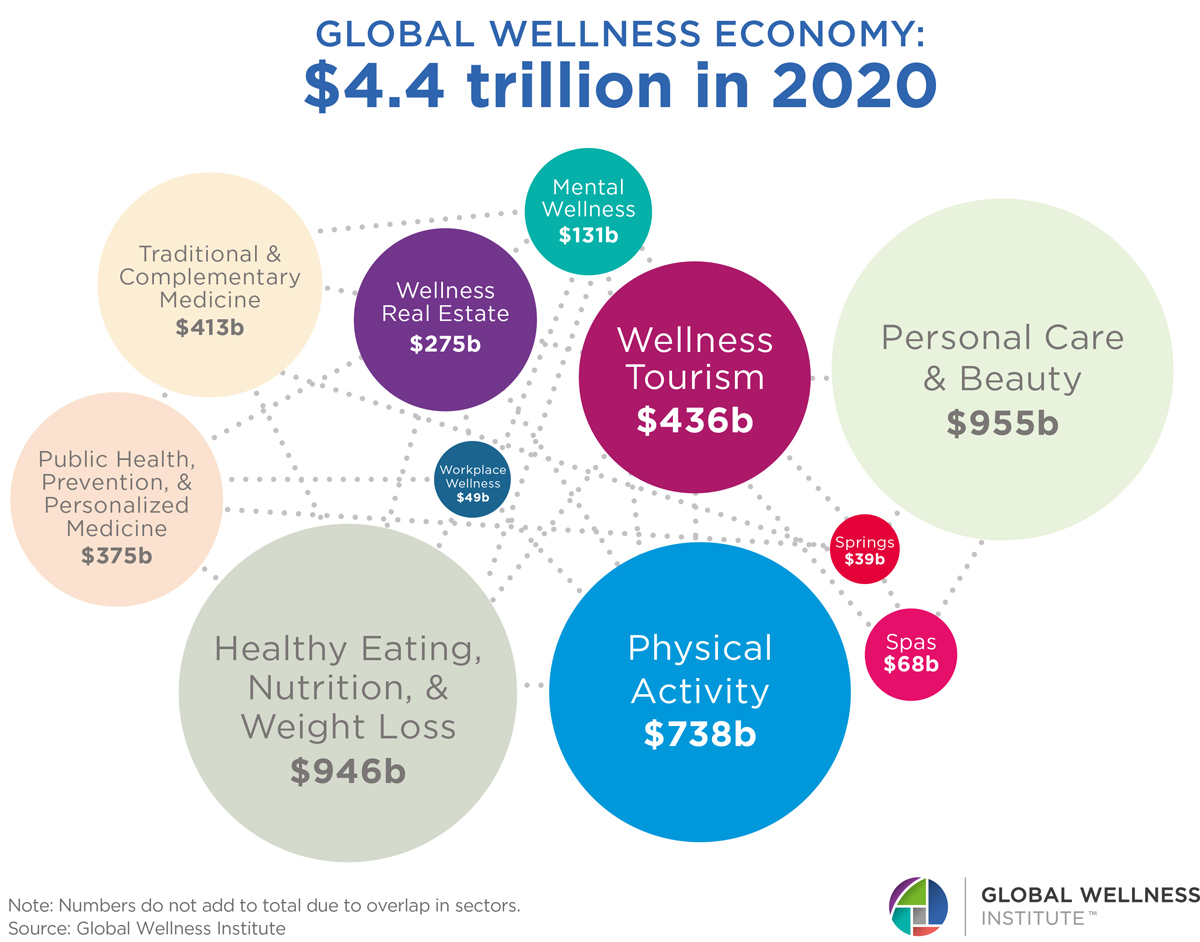

In its latest report, the Global Wellness Institute has taken a deep dive into the impact the pandemic has had on the $4.4tr global wellness economy.

• Between 2017 and 2019, the global wellness industry was showing an annual growth rate of 6.6 per cent, growing from $413tr (€363tr, £309tr) in 2017 to $4.9tr (€4.37tr, £3.67tr) in 2019. In 2020 it fell by 11 per cent to $4.4tr (€3.93tr, £3.29tr).

• Asia-Pacific was one of the fastest growing wellness markets from 2017 to 2019 (8.1 per cent growth). Buffered by high growth rates for wellness real estate, as well as public health, prevention and personalised medicine, it was the region which shrank the least during the pandemic (-6.4 per cent).

• While North America enjoyed the most growth between 2017 and 2019, it as was also the hardest hit by the pandemic (-13.4 per cent). The Latin America-Caribbean regional wellness market saw the greatest decline (-22.1 per cent).

• From 2017 to 2019 the spa industry was growing at a rapid pace, but revenues fell by 38.6 per cent in 2020 to $68bn (€60.7bn, £51bn). It is still difficult to assess the number of permanent business closures, but an estimated 22 new destination spas opened during 2020.

• Despite the pandemic, some sub-sectors of the wellness market expanded in 2020. Wellness real estate grew by 22.1 per cent (see wellness real estate feature in this issue). Mental wellness expanded by 7.2 per cent, as people downloaded apps and brought accessories such as weighted blankets.

• Public health, prevention and personalised medicine grew by 4.5 per cent. Healthy eating, nutrition and weight loss grew by 3.6 per cent, as people looked for supplements and foods which would boost their immunity. Although the physical activity sector shrank overall, the fitness technology subsector exploded by 29.1 per cent.

• However, the lockdowns inevitably led to contraction in some sectors. Personal care and beauty shrank by 13 per cent and spend on

• Adversely affected by the travel restrictions and stay at home orders, wellness tourism was reduced by 39.5 per cent; spas lost 38.5 per cent and thermal springs were down by 38.9 per cent.

• However, those which took the greatest hit also have the highest growth projections. GWI predicts the global wellness economy will grow by 9.9 per cent annually, reaching $5tr (€4.46tr, £3.74tr) in 2021 and nearly $7tr (€6.24tr, £5.24tr) in 2025.

• The reports assesses the value of the 11 segments of the $4.4tr (€3.92tr, £3.29tr) global wellness industry

Traditional and complementary medicine $413bn (€363bn, £309bn) Wellness real estate £275bn (€245bn, £206bn)

Mental wellness $131bn (€117bn, £98bn)

Wellness tourism $436bn (€389bn, £326bn)

Personal care and beauty $955bn (€852bn, £715bn)

Public health prevention and personalised medicine $375bn (€334bn, £281bn)

Workplace wellness $49bn (€44bn, £37bn)

Healthy eating, nutrition and weight loss $946bn (€844bn, £708bn)

Physical activity $738bn (€658bn, £552bn)

Spas $68bn (€61, £51bn)

Thermal/mineral springs $39bn (€35bn, £29bn)

• Spending in three regions accounted for 90 per cent of the entire global wellness economy in 2020.

Asia Pacific was the largest at $1.5 trillion (€1.34bn, £1.12bn)

North America accounted for $1.3 trillion (€1.16tr, £970bn)

Europe stood at £1.1 trillion (€980bn, £1100bn)

• Per capita, spending on wellness is significantly higher in North America $3567 (€3181, £2670) and Europe $1236 (€1102, £925) than other regions of the world.

• Appealing to an expanding segment of customers seeking to connect with nature, experience cultural traditions and pursue alternative modalities for healing, rehabilitation and prevention, thermal springs were among the fastest growing wellness sectors from 2017-2019. Revenues were growing by 6.8 per cent annually during this time, but then fell by 38.9 per cent from 2019-2020.

• Asia-Pacific and Europe account for 96 per cent of revenues and 94 per cent of establishments in this sector. There were at least 115 new openings from 2018 to 2020 across every region: 17 in 2020 at least 25 in 2021 and more than 140 projects in the pipeline.

• Not all thermal springs fared badly. In the US, China, Australia and New Zealand some establishments reported growth of 10 to 20 per cent, as customers flocked to a Covid-safe outdoor activity.

• However, those which are indoors saw business decimated by restrictions. Due to long closures and insufficient government aid, the industry is facing possible bankruptcy in Romania. In some countries, such as Slovenia, Italy and Czech Republic, governments are offering vouchers to boost the sector.

• The pandemic has changed how we view self care, which has become a means for self-preservation and survival. Self care is no longer something which is practised for an hour a day a few times a month, or on vacation. Self care is becoming increasingly embedded into daily life via home-cooked meals, human connections, good sleep, time in nature, financial wellness, search for purpose, meaning and much more.

• With 15 per cent of the global population suffering from mental health issues and substance use disorders, as well as rising dementia, stress, worry, sadness, burnout and loneliness, it is a dire landscape for mental health.

• However, mental wellness offers a path forward to help meet widespread needs and increase wellbeing for all. The number of people using the top three global meditation apps rose by 59 per cent in 2020.

• Although the pandemic has caused more mental health issues, it might help to reduce the stigma of mental illness and has brought greater attention to the ways to cope with adversity, improve resilience, and move towards flourishing.

• The global spa industry is heavily concentrated in Europe, Asia and North America, with the top five countries - US, China, Germany, Japan and France - accounting for 50 per cent of global revenues in 2020. The top 20 countries represent 78 per cent of the global market.

• Asia-Pacific has the largest number of spas and Europe has the highest spa revenues. Day spas serving local customers were more buffered against the pandemic related decline than destination spas which were hit by travel restrictions and saw the greatest revenue declines in 2020.

• The wellness sectors most adversely affected by Covid were those requiring a physical presence, so there was a drop in wellness tourism: 601 million trips were taken in 2020 compared to 936 million in 2019.

• Europe boasts the largest number of wellness trips and North America leads in terms of expenditure. However, Asia-Pacific and Middle East-North Africa were the fastest growing regions.

• The grey area between wellness tourism and medical tourism is growing as further services are added, such as DNA testing, executive checkups, detoxes and cleanses, hydrotherapy/balneotherapy.

• The pandemic has accelerated the incorporation of medical type offerings by more spas and wellness businesses, hoping to capture new markets. While some medical spas are transforming their spaces to become less sterile and more spa-like.

• Wellness travel is likely to be boosted with a rising trend of people taking wellness sabbaticals or workcations. Consumers may well seek hotels which promise good sleep, for example with soundproofing, circadian lighting, air filtration, fitness and physical activities.

• There are indications the pandemic has accelerated demand for slow travel, transformative travel and regenerative travel. Travel which is goal based and values driven, involving personal growth and an awareness of the social and environmental impact on the destination.

• We may see consumers questioning their own environmental and social footprints and make choices based on these concerns. The rising consumer appreciation and desire for nature will push wellness businesses towards a more regenerative and environmental direction in the long term.

• There are indications of a strong resurgence in demand. Hunger for touch and human connections, travel and nature and wellness experiences is intense after more than a year of social distancing, quarantining and staying at home. Guests are willing to have longer stays, spend more and try out new modalities.

• During lockdown there was more research into brain health, gut microbiome, sleep hygiene, breathwork, sound healing, nature, psychedelics and other newer modalities, which offer exciting potential moving forward.