features

Interview: Nikolay Pryanishnikov

The CEO of Russian fitness operator World Class talks to Kate Cracknell about its Moscow stronghold, 50 per cent PT revenues, and new boutique and low-cost ventures

When, and why, did you join World Class?

I joined World Class in September 2015 – from a background in telecommunications and IT – when I was headhunted on behalf of Russian Fitness Group, which owns the World Class health club chain.

I’ve always loved managing people and I was drawn to the energy of the fitness sector. It’s such a fantastic industry – we help people become healthier, more successful, with improved physical appearance and self-esteem. It’s hard to think of a better job.

Can you give us an overview of the World Class business?

World Class has been operating in Russia for 24 years and currently has 82 clubs: 74 in Russia, five in Kazakhstan and one each in Kyrgyzstan, Belarus and Monaco. We’re also finalising the details for a club in Dubai, and we’re looking at opening clubs in Georgia. We focus on areas where there are already a lot of Russian speakers.

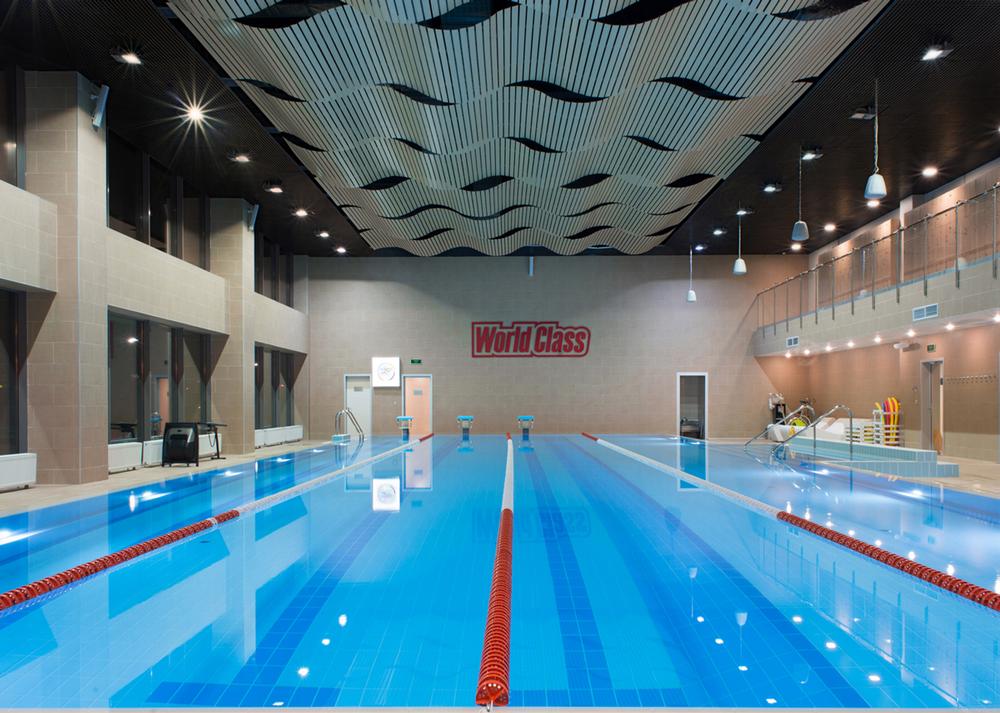

The majority of our clubs are large, premium, full-service facilities. They all have big gyms – up to – plus group exercise studios and functional training zones. Most have a large swimming pool and spa, and many also have a kids’ area.

In fact, we have various different club models operating under the World Class brand – luxury, premium, business – but they’re all high-end if you benchmark them against clubs in other markets around the world. Membership is on average US$1,000 a year.

We also have four boutique studios in Moscow: Mind & Body Studio by World Class opened in the centre of the city in February 2017, and we also have our Dance Studio. In addition, we have boutique Cycle and HIIT studios within our new club in the Metropolis shopping mall. We’ll open more boutique sites if these go well. Half of our clubs are corporately owned; the other half are franchised.

What are the USPs of World Class versus the competition?

Perhaps our most valuable asset, having been in the market for a long time, is the extensive experience embodied in our team – experience in operating health clubs, but also in attracting, developing and retaining the very best staff. In line with this, we have a new development programme, launched a year ago, where we’re training 40 great managers of the future.

We also place a lot of emphasis on building an aspirational community. Our members are young, healthy, successful – and others want to be part of it.

Customer service is also key for us – finding ways to become closer to our members. We recently reclassified reception as a ‘service desk’, and in the process, we redefined the role of the staff working on that desk. They’re now empowered to help members with anything they need. Initiatives such as this have had a huge impact on attrition, which has dropped from 30 per cent to 22 per cent across the company since I came on-board.

Technology has also been incorporated into this customer service strategy. For example, there’s an automated system to handle all customer feedback within 24 hours – and this is tracked and worked into the staff commission structure.

I also lead by example here: I have over 10,000 social media followers, many of whom are customers of World Class, so it’s easy for them to find me and give feedback. I try to have a very open relationship with customers and this is rubbing off on club managers, which is great.

World Class’ PT offering is particularly successful. Why is this?

At World Class, personal training generates 50 per cent of what we make from membership fees, based on an average PT fee of US$50 an hour. You might find one-off, independent gyms that achieve this, but you’d typically expect chains to make no more than 15 or 20 per cent. I don’t know anyone who’s making 50 per cent – certainly not across such a big chain.

That isn’t profit of course: we need to pay the trainer and pay taxes. But still, in terms of revenues and added value and additional profitability, it’s a fantastic business.

We’ve worked hard to get to this position, putting a number of strategies in place. First of all, you have to get the right people onboard: from 3,000 CVs, we interviewed 1,000 trainers and recruited 300. We only take the best. We then invest heavily in education and development, including mentorship.

There’s also an incentive scheme that encourages PTs to work hard and be as good as they can be, with commission ranging from 15 to 45 per cent depending on how well they’re performing. That means we end up with a lot of rockstar trainers.

Our marketing also helps push members towards personal training. We run lots of competitions, for example: running, swimming, weight lifting and so on, and members turn to our PTs to help them prepare.

We also have our top instructors and PTs present at the World Class Convention, as well as acting as spokespeople for our brand on social media. This not only attracts other good PTs to work with us, but also builds member awareness of our superstar PTs, and awareness of our clubs among non-members.

What are your plans for business growth?

I’ve set out three key pillars for growth. The first is to maintain market leader position in the premium sector in Moscow. We already have 30 clubs in the city; no other operator comes close, and I don’t want to give anyone the chance to. I want to grow our Moscow estate to 40 clubs over the next five years.

That’s the real focus with our corporately owned clubs: reinforcing our market dominance in the main cities of Russia. In addition to Moscow, we have five clubs in St Petersburg, and the clubs in Ekaterinburg are also corporately owned.

The second pillar is franchising, which is an aspect of the business I’m very keen to grow. We have around 40 franchised sites at the moment, and I want to grow that to 150 or even 200 over the next five years.

We have the rights to the World Class brand across the whole of Russia, as well as the markets of the CIS [the Commonwealth of Independent States, formed after the break-up of the USSR]. There are 145 million people in Russia and 130 million people across the CIS. That’s a huge opportunity, but it’s too geographically widespread for us to effectively manage clubs directly. We just wouldn’t be able to see all the managers regularly enough.

So outside of the main cities of Russia, we’ll franchise. I also foresee additional opportunities like the Monaco club. Monaco is a franchise, but we manage it on behalf of the investor.

We’ll also look at other non-Russian speaking countries. We have the rights to a number of western European markets including the UK, Germany and France, for example. But we aren’t in a hurry. We’ll move carefully, and still aren’t decided if we’ll franchise or open our own clubs.

Thirdly, we’ll look to diversify. There are clearly two big trends at the moment – boutique and low-cost – and we want to get involved. We’re piloting a boutique concept as I say, although I’m not overly optimistic about that model. It would allow us to build smaller clubs in the gaps between our larger clubs, helping us further assert Moscow dominance, but at this stage I can’t see how we’ll make serious money out of it. I don’t think many boutiques are really making much money, and it will be even harder to do so in Russia because working practices mean off-peak hours will be empty.

We’ll also be exploring the low-cost segment, either on our own or in partnership. I’d like to make some progress on that in the next year. We already have some budget clubs operating under the Fitzkult brand, as franchises, but I want to create a true low-cost brand.

In addition, although this isn’t one of the three pillars, I believe that we can generate 10 per cent more business in our existing clubs – whether that’s 10 per cent more revenue from new members joining, or 10 per cent more revenue from our existing members – simply by constantly innovating and experimenting to keep energy levels high in the clubs.

Where are the market opportunities generally in Russia?

I believe there’s still room for more premium clubs, provided you select the right locations.

The economy isn’t great in Russia at the moment, and people are looking to save money, but the very premium end of the market doesn’t seem to be affected by this: our top-end clubs are still growing.

In the last year, we’ve boosted revenues by 9.1 per cent and EBITDA by 18 per cent, and our 100,000 members are proving to be very sustainable, loyal customers. We signed up over 2,000 members in pre-sale for our latest club, for example, which opened in February this year. I believe we’re very lucky to be working in the premium segment.

The low-cost fitness club segment – operators such as Alex Fitness [see HCM May 17, p42] – also has the potential to boom. However, it isn’t easy to adapt this model to Russia where, for example, not everyone is yet ready to do everything online. You always need some staff in the clubs.

And I think there’s still space for mid-market operators too, because going to the gym is becoming more popular across all segments of society.

Zebra Fitness Clubs are a good example: they have a pool but they’re cheaper, and they’re attracting the older generations who have always turned to swimming for their exercise. Quite a lot of kids are buying memberships for their parents so they can go swimming.

But there are also challenges in Russia. The market is dominated by independents – they make up around 80 per cent of the market – and these are often businesses where someone with a lot of money has been happy to invest without seeing a solid business plan.

In the end, the clubs have to lower their prices to survive – and that affects us, as well as damaging the credibility of the sector as a whole.